On TV, you see the commercials, Opendoor will give you a “fair” offer to buy your home within 48 hours!

“Opendoor” might be a good fit for you when you decide to sell your home or it might not. Opendoor advertises you’ll have less stress selling to them rather than the traditional way listing with a Realtor.

Basically, Opendoor is a huge investor, buying homes and then reselling them for big profits.

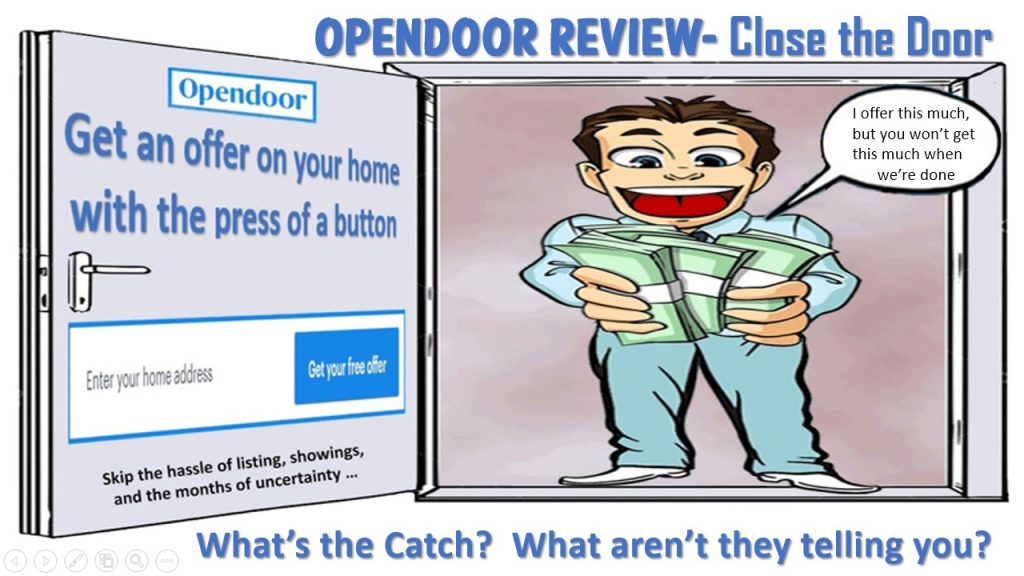

What’s the catch?

Opendoor tells you all the benefits, but what’s the catch … there’s got to be something about their offer that they‘re not telling you … what else is there about this offer that Opendoor is not bragging about?

Opendoor pushes the fact about a fair purchase offer, but their costs and fees are expensive.

Real Estate Investor startups like Opendoor (and Offer Pad) use an online algorithm to estimate home values. My research shows their fair offers average about 5% lower than fair market value, which does not seem too bad when you consider the buyer is a real estate investor.

“Fair market value” is the price your house would sell for on the open market (when listed with a real estate brokerage) based on recently sold similar homes in the same area.

For Example, if your home’s fair market value is $300,000. You will probably get an Opendoor offer of ($300,000 less 5%) about $285,000. That might work for you, but I would notice the $15,000 from my potential profit.

Opendoor charges sellers a 6% commission, plus another 1 to 2% fee… that’s at least 7.5%. And read the fine print, Opendoor has the option to charge up to 16% in fees.

The worst part is a couple weeks after you sign the contract and agree to sell to Opendoor, (you are packing up your belongings for your big move) Opendoor sends out one or more inspectors to inspect the roof, foundation, electrical, A/C & heat, windows and flooring.

Their repair estimates are often higher than you would ever expect, and they will deduct their repair estimates from your net profits. I heard of a couple that sold to Opendoor and they deducted $18,000 just for inspection repairs.

Think about it, you preparing to move, your belongings are packed and then you are told your net profit will be $18,000 lower than you planned for.

Four reasons I would close the door on Opendoor when I decide to sell my home.

- Based on my 30 years of experience most home seller complaints are when a seller doesn’t have a real estate agent in their corner, looking out for the seller’s best interests, Opendoor will not have your back.

- I would want to net maximum fair market value profits when I sell my home.

- You can find cheaper contractors to get your home in move-in condition.

- If you request an offer from Open door, and you change your mind, it is possible they will sell your contact information to other companies, that will come knocking on your door!

Bottom-Line

In my opinion, I want to pocket as much money as I can when I sell, so I would close the door on Opendoor.

If you are in the San Antonio area and want to know how much your home is worth, or a second opinion, contact me through my website @ https://LesEarls.com .

#Opendoor review